As luxury markets try to build back inventory to pre-pandemic levels, some areas are seeing robust new growth amid continuing strong demand from buyers and restored confidence among builders and developers.

A lack of existing inventory and solid demand in the U.S. helped offset rising mortgage rates and pushed single-family home production higher, with overall housing starts increasing 7% in September 2023 to a seasonally adjusted annual rate of 1.36 million units, according to a recent report from the U.S. Department of Housing and Urban Development and the U.S. Census Bureau.

Within this overall number, single-family housing starts increased 3.2% to a 963,000 seasonally adjusted annual rate. Note, though, that single-family starts were 12.8% lower year-to-date due to higher interest rates. The multifamily sector, which includes apartment buildings and condos, increased 17.6% to an annualized 395,000 pace, according to the report.

In South Florida, luxury new development in West Palm Beach is “booming,” says Sonja Stevens, senior global real estate advisor, Sotheby’s International Realty - Palm Beach Brokerage.

The Bristol, which launched in 2016, features 69 units in a 25-story tower on South Flagler Avenue, and “sold out pretty quickly,” with prices ranging from US$5 million to just under US$44 million, she says. “It’s been a tremendous success, and people doubled and tripled their investments on resales,” with prices ranging from US$16 million to US$23 million.

Forté on Flagler, a collection of 41 four- and five-bedroom luxury condos that launched in 2019, has also done quite well, Stevens says. “I think there are four left, priced from US$5 million to over US$8 million.”

Sales at the 275-unit, 26-story Olara luxury condo tower on North Flagler Drive in West Palm Beach are also doing well, she says.

“Inventory during the pandemic went down to nil,” Stevens says. “It’s not huge now, but better, and prices are still extremely high. In fact, I’ve never seen prices here go down, even in 2008.”

Related Cos., which is based in New York, “is putting up several new buildings in West Palm,” including South Flagler House, which features two 28-story towers designed by the highly regarded architect Robert A.M. Stern and his firm, RAMSA, she says. The marketing of the building will likely start later this year.

South Flagler House, which will feature two- to five-bedroom units with prices starting at US$7.5 million, will be RAMSA's first foray into the luxury residential high-rise market in Florida.

A boom of new development is also rolling through Park City, Utah, a popular winter ski destination.

“There is a lot of luxury construction going on in the Park City area,” says Sheila Hall, associate broker and real estate agent, Summit Sotheby’s International Realty. “Luxury builders are very, very busy in Park City.”

An entirely new ski resort is being built, operated by Deer Valley ski resort, she says. Lot prices for single-family homes in this new, so far unnamed village range from US$2.5 million to US$6.5 million. “I just closed on one where a buyer from Connecticut paid US$5.25 million for a half-acre lot.”

And then these buyers will pay from “US$5 million to US$15 million for the house itself,” says Hall, who lives in Park City. “Our consistent feeder markets are the New York metro area, Miami, Texas, California, and Chicago.”

The market for new luxury condos in Park City, many of which have a hotel component, is also quite active, she says.

Along with being a resort destination, Park City is also a suburb of Salt Lake City with “great access to the airport,” she says. “That’s a big selling point for us.”

Because it’s just 30 minutes from Salt Lake City, Park City also attracts a lot of professionals willing to pay more for housing and make that commute, she says.

The core of Park City is quite landlocked because of the surrounding mountains, and growth has moved into outlying areas that used to be farmland, Hall says.

Buyers' or Sellers' Market Ahead?

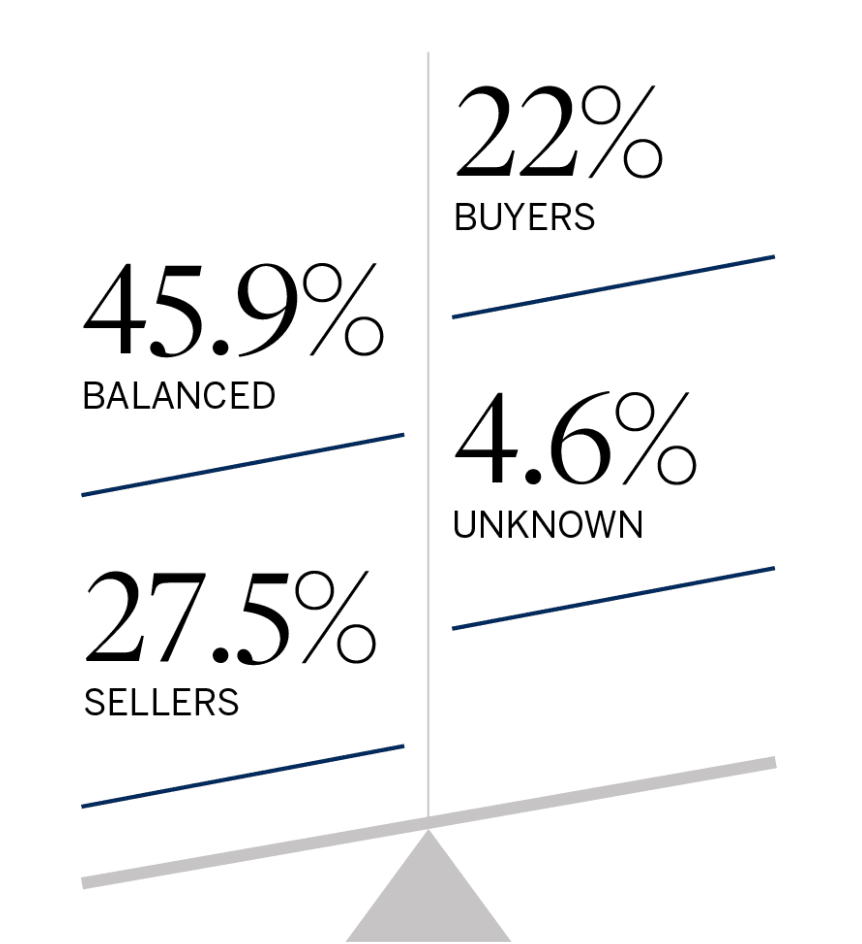

Most agents see a balanced market ahead.

Source: Sotheby’s International Realty Luxury Outlook 2024 Agent Survey

The luxury market has become the bulk of the housing market, she adds.

Outside the U.S., Thailand is also seeing a renewed demand for new luxury real estate. “There is a clear demand for luxury housing projects and new luxury condominiums, driven by limited supplies and evolving buyer preferences,” says Phakrjira Jansakran, director of sales, List Sotheby’s International Realty, Thailand, which specializes in luxury residential property in Bangkok and other major resort destinations in Thailand.

Builder confidence remains strong in Thailand’s luxury housing market, with both small and large developers expressing confidence in the country’s property growth, she says. “This is reflected in consecutive project launches compared to the past two years.”

Builders and developers in the luxury housing market have been proactive in upgrading designs and creating spaces that cater to new needs and desires, Jansakran says. “The shift in buyer preferences, favoring housing over condominiums since the pandemic began, has prompted this response.”

In particular, houses with larger living spaces and enhanced privacy are drawing lots of interest, she says. “Additionally, downtown condos, branded residences, and innovative projects like healthcare and wellness properties are attracting attention.”

“Luxury housing primarily appeals to Thai buyers,” while the condominium market has seen increased interest from buyers from Southeast Asia and the Middle East, she says.

In recent years, the new condo supply has been abundant, “comprising over 95% of developments in midtown and suburban markets,” Jansakran says. However, the downtown supply has been less robust, “at less than 70% of pre-Covid levels. Over the last couple of years, there has been a notable focus on the domestic own-use market.”

In Eagle County, Colorado, the Vail and Beaver Creek luxury markets have been particularly busy, says Vail-based Matthew Blake, broker associate, LIV Sotheby’s International Realty, whose expertise is new developments.

“Here, we are essentially an island surrounded by national forest land,” he says. “There is a fixed supply of inventory and not a lot of vacant land. We’re pretty much all built out.”

Vail-Beaver Creek, which is less than two hours from Denver, is a “very sophisticated, cosmopolitan ski resort area, with a sophisticated arts and restaurant scene,” he says. “Post-Covid, people really want to spend time here in the mountains, and Covid gave people that permission to do it.”

Vail was developed in the early 1960s and Beaver Creek in the early 1980s, so a lot of the existing housing can be quite dated, Blake says. “New development tends to fare very well here.”

The first phase of a new development known as Frontgate Avon, which opened in 2022 and has a total of 75 condos and nine townhomes, is “over 85% sold,” he says. “Every eight to 10 sales, we raise the prices, and we’re still getting a very strong absorption rate.”

Inventory Through the Years

Surveys of Sotheby’s International Realty agents from 2022 through 2024 have shown inventory is very low in the majority of markets, with the exception of 2023, when the majority of respondents said inventory was moderate. High-inventory areas are in the vast minority.

INVENTORY IN 2024

38.53%

VERY LOW (OUT OF 40%)

31.19%

LOW (OUT OF 40%)

25.69%

MODERATE (OUT OF 40%)

4.59%

HIGH (OUT OF 40%)

0%

VERY HIGH (OUT OF 40%)

INVENTORY IN 2023

32.95%

VERY LOW (OUT OF 40%)

28.41%

LOW (OUT OF 40%)

34.09%

MODERATE (OUT OF 40%)

4.55%

HIGH (OUT OF 40%)

0%

VERY HIGH (OUT OF 40%)

INVENTORY IN 2022

37.20%

VERY LOW (OUT OF 40%)

35.90%

LOW (OUT OF 40%)

22.80%

MODERATE (OUT OF 40%)

2.80%

HIGH (OUT OF 40%)

1.40%

VERY HIGH (OUT OF 40%)

“It’s the first big post-pandemic development we’ve had out here,” Blake says. “In light of the pandemic and what buyers are looking for, they have larger floor plans, more offices, and large outdoor spaces. People particularly like the large one-level floor plans.”

Most of the units are in the US$1.9 million to US$2.5 million range, with some going as high as US$4.5 million, he says. “We keep setting price-per-square-foot records over and over again.” The second phase is under construction, with a December 2024 completion date.

For the Vail—Beaver Creek area, the Frontgate Avon prices are “very much midmarket,” Blake says. “Things have gotten really expensive here. We now have more sales over US$5 million than under US$500,000 in the county,” and over the past three years, 85% of his buyers are paying all cash.

In Eagle County, the average price for a single-family home is US$1.8 million, and in Vail that soars to US$10 million, he says.

“Our overall sales volume is down, but prices are up, and we still have lots of inventory challenges,” Blake says. In all of Eagle County, there are now 350 listings, compared with 800 to 900 in 2018 and 2019. “Our inventory is still historically low.”

In the central Oregon city of Bend, luxury resales are driving the market, says Brian Ladd, principal broker, Ladd Group, Cascade Hasson Sotheby’s International Realty. “We sell a lot in the US$2 million to US$5 million range in Bend.”

The median price in the city is US$750,000, he says. “Our average is the US$1.3 million price point.”

Pending sales are flat year over year, but because there is so little inventory, prices are up 5% year over year, he says.

Inventory is still about half of what it was historically, but it’s up 50% year over year, Ladd says. “The pandemic ate up all of our inventory. At one point in 2021, we had less than 30 days of luxury-market inventory, compared with a normal of six to nine months of supply.”

“We are running out of land inventory,” he says. There are 10 to 15 luxury residential lots on the market now, compared with a typical number of 50 to 100.

“Because there is so little luxury inventory, our market is primarily driven by resale or the construction of new custom homes,” he says.

“From 2007 and 2008 through 2013, ’14 and ’15, there was very little high-end new construction in our market,” Ladd says. The ones built since then are now seeing their first turnover for resale.

In the Tetherow resort community in Bend, 450 custom-home sites were sold directly to the consumer, starting in 2011 and 2012, he says. “It was a large driver in custom-home sites in our market.”

Those US$400,000 and US$500,000 homes are “now selling for close to the US$1 million mark,” he says.

“There is a clear demand for luxury housing projects and new luxury condominiums, driven by limited supplies and evolving buyer preferences.”

Phakrjira Jansakran

Director of sales, List Sotheby’s International Realty, Thailand