An intensely awaited development for the U.S. housing market this year is a long-anticipated fall in interest rates. While inflation has dropped over the past year, this progress has been slow, and officials within the Federal Reserve, the country’s central bank, have kept interest rates at 5.25% to 5.5%—a 23-year high—since July 2023.

Where the Federal Reserve leads, mortgage rates follow. The average 30-year rate reached a peak of 7.79% in October 2023, the highest level in 20 years, according to national mortgage lender Freddie Mac. As a result, property sales have been on a steady decline over the past three years, based on U.S. Census data. The difficulty in securing a property during this higher-rate cycle even led U.S. President Joe Biden to comment on the issue in his State of the Union address in March 2024.

He proposed a US$10,000 tax incentive designed to encourage first-time buyers and those wanting to sell their starter homes. “I want to provide an annual tax credit that will give Americans US$400 a month for the next two years as mortgage rates come down to put toward their mortgage, when they buy a first home or trade up for a little more space,” he said.

With another presidential election taking place in November 2024, concerns that the Federal Reserve’s decision on rates might be further delayed were dismissed by its chairperson Jerome Powell, who said the bank’s policymakers will “do what we think is the right thing, when we think it is the right thing.”

Industry experts expect borrowers to get a bit of breathing room by 2025, however. The Mortgage Bankers Association estimates that rates will fall to about 5.9% by 2025, while Wells Fargo has made a similar forecast of 6%. In mid-June 2024, the Federal Reserve projected that it would only make one cut to interest rates this year, with Powell saying the “restrictive” policy “is having the effect we would hope for” in stabilizing the economy.

“I believe we can say with some certainty that U.S. mortgage rates will be lower at the end of the year,” says Anthony Chan, former chief economist, JPMorgan Chase. He anticipates that the rate at the end of 2024 will be around 6.4% and will fall to 5.9% in 2025.

“As buyers see lower rates, they will be less worried about the ‘lock-in effect’—the hesitancy of selling their house if it means taking out a higher-rate mortgage for their next home,” adds Chan. “This will ultimately support housing activity if the economy avoids a slowdown.” Fears of a downturn have dropped significantly, with JPMorgan Chase reversing its prediction in 2024. At a speech at the Economic Club of New York at the end of April 2024, the bank’s Chief Executive Officer Jamie Dimon said the economy was “booming,” adding that “the American consumer—even if we go into recession—is much wealthier than before.”

Mortgage Rate Predictions

Current rate in May 2024 (Freddie Mac)

2025 (Fannie Mae)

2025 (Wells Fargo)

Less means more

While leading institutions predict interest rates will decline, homebuyers face other roadblocks to securing a property: rising prices and low inventory. Although the number of homes on the market has risen this year, according to data released by the National Association of Realtors in April 2024, the projected time it would take for this current inventory to run out if no additional homes were built or offered for sale is 3.2 months—well below the six-month national average. Inventory for newly built homes is above this average, at 8.3 months, according to U.S. Census data.

This, in turn, could create upward pressure on prices until inventory reaches normal levels. Investment bank Goldman Sachs estimates that property prices will rise in the U.S. due to pent-up demand. According to Roger Ashworth, the firm’s senior strategist on its structured credit team, and analyst Vinay Viswanathan, home prices could rise by 5% in 2024, and by 3.7% in 2025.

J.P. Morgan Private Bank advised its clients in April 2024 that “now is a good time to buy a luxury home.” The bank said this was because the luxury market “is not impacted by changing mortgage rates like the overall housing market is” but is driven by increases in total net worth. “A post-pandemic surge in the total wealth of the top-income households… has spurred dramatic gains in luxury housing prices,” the bank added, and “that shows no signs of abating.”

Cities such as Chicago, Illinois are already seeing this effect. “Lincoln Park has been more in demand than I have seen in 20 years due to the lack of inventory and the healthy amount of appreciation over the past few years,” says Sam Jenkins, vice president of sales, Jameson Sotheby’s International Realty. “Good inventory that is priced correctly is few and far between.”

3.2 months

The time it would take current house inventory to run out (April 2024). Source: National Association of Realtors.

Despite the 5%-10% increase in prices, he says the Chicago market is fairly accessible. “But the time is now if you are looking at the big picture in the long-term,” adds Jenkins. “By next spring it could be a frenzy again, with multiple bids and more demand waiting in the wings.”

In New York City, prices could be tempered as sellers who have been waiting for a year or more finally list their properties. “It is likely that as interest rates fall, sellers will feel more bullish about the market and finally list their ‘warehoused properties,’” says Jonathan Hettinger, senior global real estate advisor, Sotheby’s International Realty - Downtown Manhattan Brokerage. “This increase in supply could limit the price appreciation we would normally expect in a declining interest rate environment.”

In New York City, the market for luxury properties selling above US$4 million has been somewhat insulated from the rise in interest rates. “This is because many such purchases are done on an all-cash basis,” says Hettinger. “It’s likely that a decline in interest rates will impact lower-priced properties more than those at the top end. Cash buyers always have a major leg-up on buyers who require a mortgage—I don’t see this changing.”

George Ballantyne, global real estate advisor, Gibson Sotheby’s International Realty in Boston, Massachusetts, agrees. “I don’t think I have any luxury buyers who have mentioned interest rates during their search or negotiation,” he says. These buyers have other sources of financing and their offers are not contingent on them obtaining a mortgage, adds Ballantyne.

A similar effect is seen on the West Coast, where “many Bay Area residents have access to substantial assets, whether they are personal or familial,” says Alex Hachiya, senior real estate advisor, Sotheby’s International Realty - San Francisco Brokerage. “Now more than ever, sellers prefer to work with buyers who make all-cash offers.”

Hachiya also echoes a warning about waiting for interest rates to come down, as this “will most likely mean buyers will end up paying a higher purchase price, since additional buyer activity will drive prices up.”

In general, a more important factor in the luxury field is how U.S. equity markets are performing and what returns are being generated, says Chan. “If investors are doing well, as they did in 2023 and have so far in 2024, that will boost demand for luxury housing.” Buyers who have seen massive gains in their stock market portfolios may also opt for slightly more expensive homes when interest rates start declining, he says, as a way to secure those profits.

Number of homes currently on the market

Source: National Association of Realtors.

A custom-designed O’Brien Harris kitchen lies at the heart of each residence at One Chicago in Chicago, Illinois.

Jameson Sotheby’s International Realty

Global ripples

Global financial markets are interconnected, so a change in U.S. interest rates affects capital flows in other countries, which in turn can lead to changes in interest rates, says Paulo Fernandes, owner and CEO, Paris Ouest Sotheby’s International Realty in Paris, France.

Europe’s real estate markets have already seen some softening—prices for residential properties declined by 0.3% in the EU in 2023 and 1.1% in the Eurozone, based on data from Eurostat released in April 2024. The largest drop occurred in Germany (7.1%) where economic growth has been slow, while prices rose in Bulgaria (10.1%), Croatia (9.5%), Lithuania (8.3%), Poland (13%), and Portugal (7.78%) due to higher growth.

Any impact felt in France from falling interest rates in the U.S. will be “indirect, complex, and may take some time to materialize,” says Fernandes. “It is difficult to give a precise time frame, as it depends on many factors and how the financial markets and central banks react to the new conditions. The national economy and the state of the political sphere should also be taken into account. These can attenuate or amplify the impact.”

The same applies on the other side of the world. “If interest rates increase, the yen will appreciate, which may impact the number of inbound clients for a bit,” says Mugi Fukushima, director, List Sotheby’s International Realty, Japan. “Overseas clients account for 30% of our clientele, so we’re watching what happens [in the U.S.] quite closely.”

This transformed bungalow in Auckland, New Zealand, is nestled into the mountainside.

New Zealand Sotheby’s International Realty

Housing price changes in key European countries (April 2024)

Source: Eurostat

“Some estimates suggest that it takes between one and two years for U.S. monetary policy to have its maximum effect,” says Julian Brown, managing director and founder, New Zealand Sotheby’s International Realty. “However, there is a large degree of uncertainty because the structure of the economy changes over time, and conditions vary.”

Fluctuating exchange rates are important to how attractive the New Zealand property market is. “We have a lot of international interest, especially from the U.S., due to the weaker New Zealand dollar,” says Brown. Buyers who are interested in purchasing homes in New Zealand also have more flexibility when it comes to mortgages, as they can be split into multiple loans at different terms and rates.

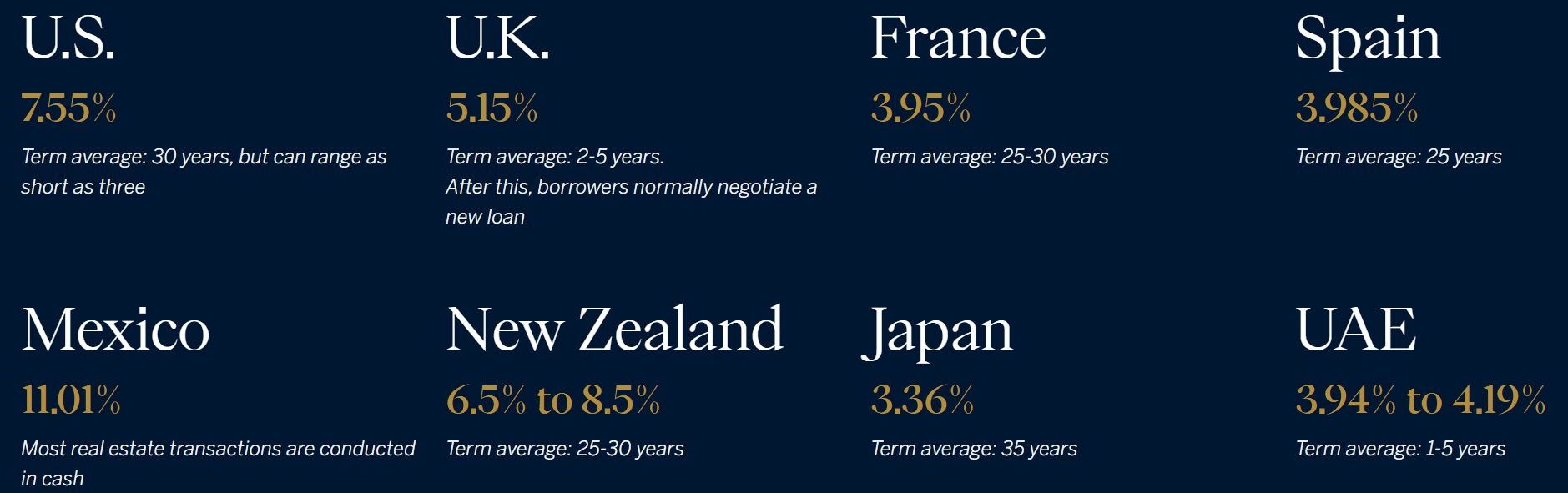

Buyers in the U.S. should also be aware that while 7.55% may be the standard for a 30-year fixed-rate mortgage there now, they vary globally, averaging 3.95% in France for example, or as high as 11.01% in Mexico, where most property deals are primarily done in cash. These rates are influenced by various factors, including the monetary policy of central banks, the local inflation rate, and each country’s economic growth.

“The bottom line is that residential real estate markets in the United Kingdom, Europe, and Asia are influenced by economic growth, while luxury markets are more influenced by local equity markets,” says Chan. “In Asia, Thailand and Malaysia are facing some growth headwinds. After a recession, New Zealand may recover during the second half of the year. South Korea is expected to enjoy stable economic growth. Japan may be slowing down, but is coming back with a booming equity market, which should boost sales of real estate.”

“THE TIME [TO BUY] IS NOW IF YOU ARE LOOKING AT THE BIG PICTURE IN THE LONG-TERM” - Sam Jenkins, vice president of sales, Jameson Sotheby’s International Realty in Chicago, Illinois

How mortgage rates work in different countries

Mortgage rates vary widely across the world, as does the typical term of a loan. There are also many variations in the types of deals offered by mortgage lenders, from long-term or time-limited fixed-rate deals to variable rate loans tied to the current interest rate.

Based on information gathered through financial websites, including Bankrate and Statista, local banks, and Sotheby’s International Realty agents, below are the current average mortgage rates in eight countries as of June 2024.